Introducing a First-of-Its-Kind Award

In The Insurance Industry

Introducing a First-of-Its-Kind Award In The Insurance Industry

Be Recognized as One of the Top 10

Favorite Advisors in Your Country,

Chosen by Your Clients, Celebrated

Nationwide!

Be Recognized as One of the Top 10 Favorite Advisors in Your Country, Chosen by Your Clients, Celebrated Nationwide!

Gain spotlight at the Prestigious APFinSA Awards 2025

in Bangkok, Thailand on May 26th!

Gain spotlight at the Prestigious APFinSA Awards 2025 in Bangkok, Thailand on May 26th!

There are over 2.81 million

insurance agents across Asia.

How can you make sure you stand out and stay unforgettable to

your clients?

In today’s insurance industry, competition is fiercer than ever.

With a surge of young talent entering the market, clients are spoiled for choice,

And products have also become commoditized.

From a client’s perspective, every insurance company seems the same.

Every advisor promises to be the best, but clients have no way of knowing who truly delivers.

On top of this, a shifting economic landscape and growing skepticism toward financial products have made it harder than ever to close clients or hit new sales goals.

Competing on a better financial product no longer works.

Instead, you MUST sell trust before selling your advice - it’s your secret weapon.

In today’s world, the fastest way to build trust is through reviews,

And almost every client makes decisions through your review.

But how can you build reviews that feel real and credible to your clients?

The insurance industry lacks a clear way for clients to identify the right financial advisor.

That’s why My Favorite Advisor was created

It’s not just another plaque for your office wall.

It’s a title reassuring future clients that you are trustworthy and exceptional at what you do.

Already trusted by 100,000 financial service professionals across 11 country associations,

This industry-first award helps you stand out and attract more clients.

Backed by Asia Pacific Financial Services Association (APFinSA), My Favorite Advisor is a proven way to win trust and grow your business.

This is the first award of its kind—and a must-have if you want to make life easier in 2025.

Become My Favorite Advisor today.

Will this award really make an impact on my career?

Here’s what Eric, one of Asia’s top personal branding experts,

Had to say about the MFA:

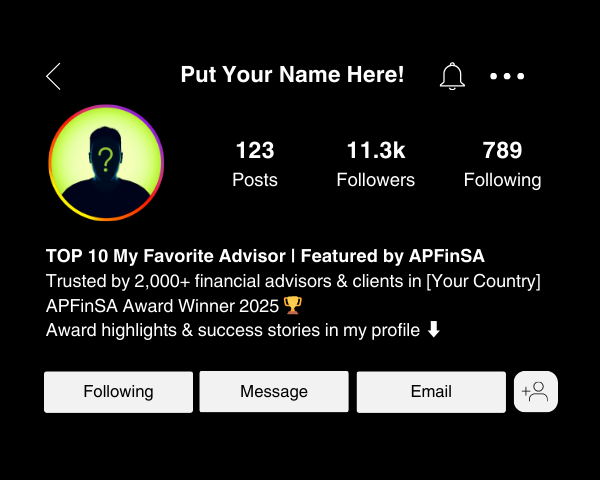

Picture This As Your Title on Social Media: